24/05/ · Forex swap is not actually a physical swap. Instead, a swap in Forex is an interest fee which needs to either be paid in or will be charged (added) to your account when the day’s trading comes to an end. So you will either be paid out at the end of the day or you will have to pay in. There are two types of swaps. The first swap is a long swap What is the Forex Swap and How Does it Affect My Trading And Forex Short Swap Long List Product. How the Buy long – Sell short operations work in Forex When trading, a forex trader will buy or sell or, to put it in the jargon, will go long or short on a determined underlying, which for the foreign exchange market will be a currency pair

Forex Swap Explained (): In-Depth Guide /w Examples ✅

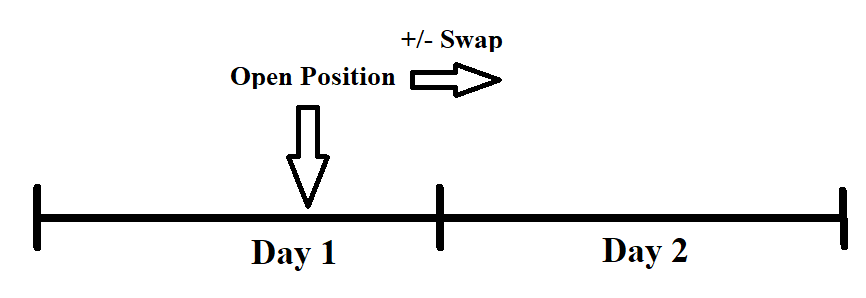

Have you been looking at opening a trading account and found yourself puzzled trying to understand what is a Swap in Forex? A Swap in Forex is an interest payment that you either settle or collect for carrying positions overnight into the following day. Swaps in Forex play an important, yet confusing role and they affect your trading strategy, sometimes without you even noticing.

Unfortunately, the phrase Swap can have a different meaning in varying contexts. Allow us to enlighten swap long and short forex. In this article, we will explain precisely what is a Swap in Forex from the perspective of a Forex and CFD trader. A Swap in Forex is sometimes referred to as a Rollover, as you roll the trade over to the following day.

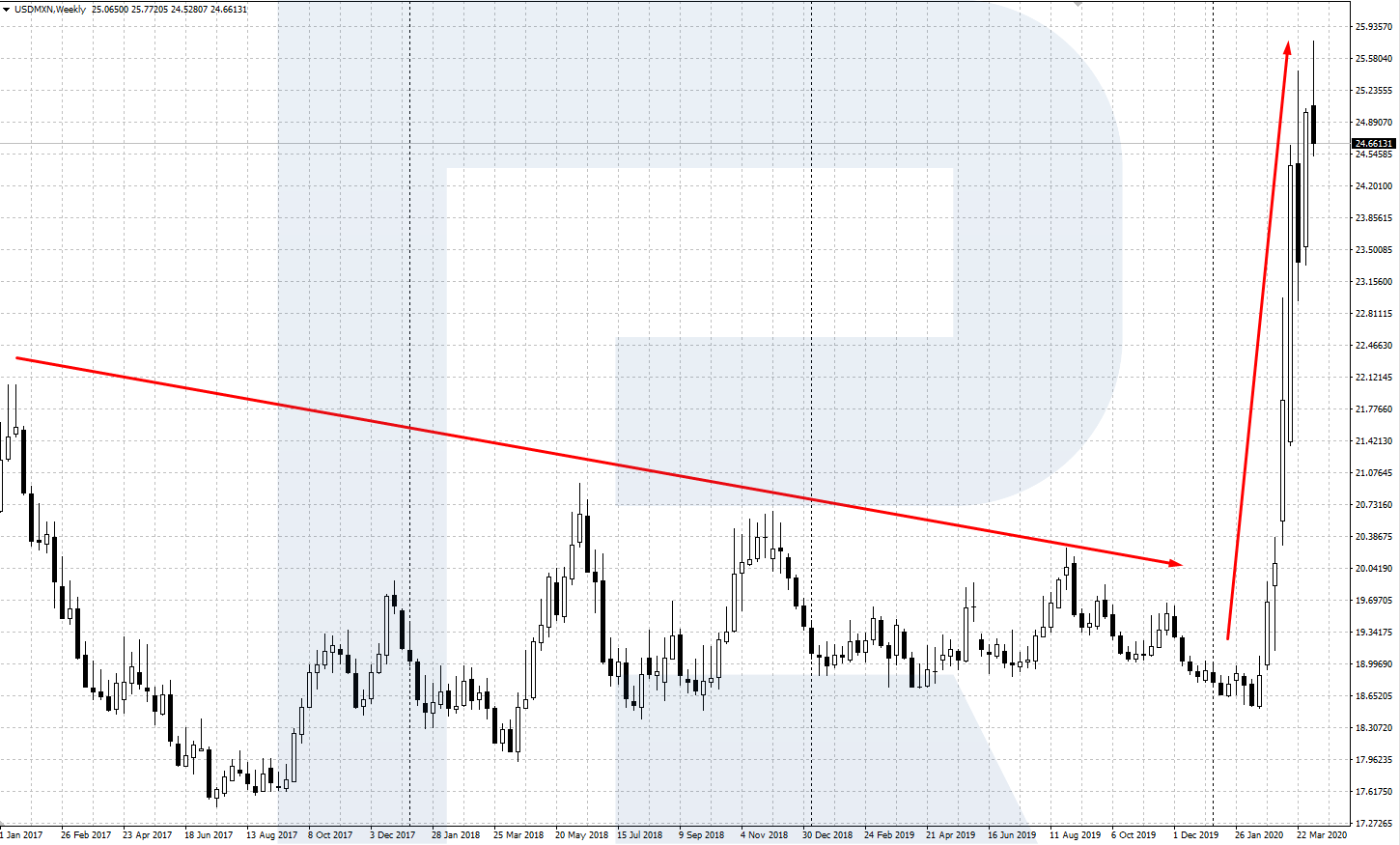

Every currency pair will have a different Swap Rate that is applied to either Long or Short positions. Brokers often update the Swap Rates in their trading platforms to reflect the market, swap long and short forex. Unlike the Bid and Swap long and short forex prices which update several times a minute, Swap Rates are swap long and short forex once a day at most, but sometimes less often than that.

When you trade Forex with an online CFD broker, you do not and will not take physical delivery of any of the currencies you are trading. All profits are settled in the same currency as your trading account is denominated in. If your trading account is set in GBP, all profits are settled in GBP. This means you are essentially borrowing any currencies you are trading. Even if you trade without leverage, you still will pay or earn exactly the same Swaps as if you had a leverage setting on your account.

If you are Long EUR vs USD, then you are giving Euros and borrowing US dollars. This means you are earning interest on the Euros and paying interest on the US Dollars you are temporarily borrowing.

The Swap Rate will be determined by the set interest rate differential between the two currencies, which in this example would be the interest rate for depositing Euro minus the interest rate for borrowing US Dollars.

Unfortunately, the Forex Swap rates you get from your broker are likely going to be watered down so much so that it would be unlikely that you could make a profit from positive Swap Rates. For an online Forex trader, the conditions are very different. In fact, you could be paying Swaps for swap long and short forex your trade open for just ten-minutes.

Unless you have a Swap-free trading account, Swaps are charged at 4. The end of the New York session is the end of the trading day. Moments later, a new trading day begins as swap long and short forex Auckland session begins. When you hear that Swaps are related to interest rates, you might think they are expressed as percentages or easy to understand dollar amounts, swap long and short forex. In fact, retail Forex trading accounts calculate Swaps in Points. This notion is relative to the fact that SpreadsCommissions, Profits and losses all revolve around Pips and Points.

The Swap Rate for Euro vs. US Dollars is In this example, you would be paying Swap charges for both Long and Short positions, swap long and short forex.

For a long position, swap long and short forex, you would pay 0. New Forex traders often overlook Rollover costs when looking for a broker to trade with. Researching what is a Swap in Forex is often an afterthought for many traders.

Always compare and evaluate Swap rates when choosing a broker as you never know when you will need to carry a trade over to the next day. You can also expect to see Swaps used for other instruments offered by many Forex brokers. For example, Gold vs. US Dollar or DAX vs Euro. Heinrich is a forex and CFD enthusiast with a passion for writing good informative quality content. He strives to showcase the best forex brokers in Africa.

Join him on his Journey! With an…. Therefore, these…. These prices update…. Username or Email Address. Remember Me. Read Review. Home Forex Trading Course What is Swap in Forex? What is Swap in Forex? Categories: Forex Trading Course Author: Heinrich Le Roux. Date: 9 Jan AvaTrade is truly a global broker, regulated across 5 continents. Local support. Sign up Sign up. Review Sign up Sign up CFD service.

Your capital is at risk. Table of Contents. Heinrich Le Roux. Content Writer Market Analyst. What is Forex? What is Forex Trading? What is CFD Trading in South Africa? How Does Forex Trading Work? How to Trade Forex? How to Start Forex Trading? How to Trade Forex for Beginners? What is Spread in Forex? What is Leverage in Forex? Leave a Reply Cancel reply You must login in order to comment a review. Login Username or Email Address Password Remember Me. Visit Broker. Minimum Deposit. Welcome Bonus.

Help me sign up. Let us help you get started!

What is Forex Swap? The hidden cost of trading FX explained

, time: 13:27What is Swap in Forex? - A Beginner's Guide • TradeFX

21/05/ · In other words, A swap in forex is the interest earned or paid for a trade open at least overnight or for multiple days. Swaps are also called Rollover. For example, OctaFX charges pips on Swap short and pips on Swap long. You can check out swap charges by OctaFX on major currencies. Swap = Standard lot x (pip x swap interest 01/09/ · You can open the Contract specifications page to monitor the Forex Swap rates table: our table includes Swap Long and Swap Short rates. Let's look at an example: take the AUDCAD Forex pair. Swap Long (in this case, ) is the interest rate that is applied to your trade if you buy AUDCAD and keep the position overnight (meaning that you will And Forex Short Swap Long List Product. How the Buy long – Sell short operations work in Forex When trading, a forex trader will buy or sell or, to put it in the jargon, will go long or short on a determined underlying, which for the foreign exchange market will be a currency pair

No comments:

Post a Comment