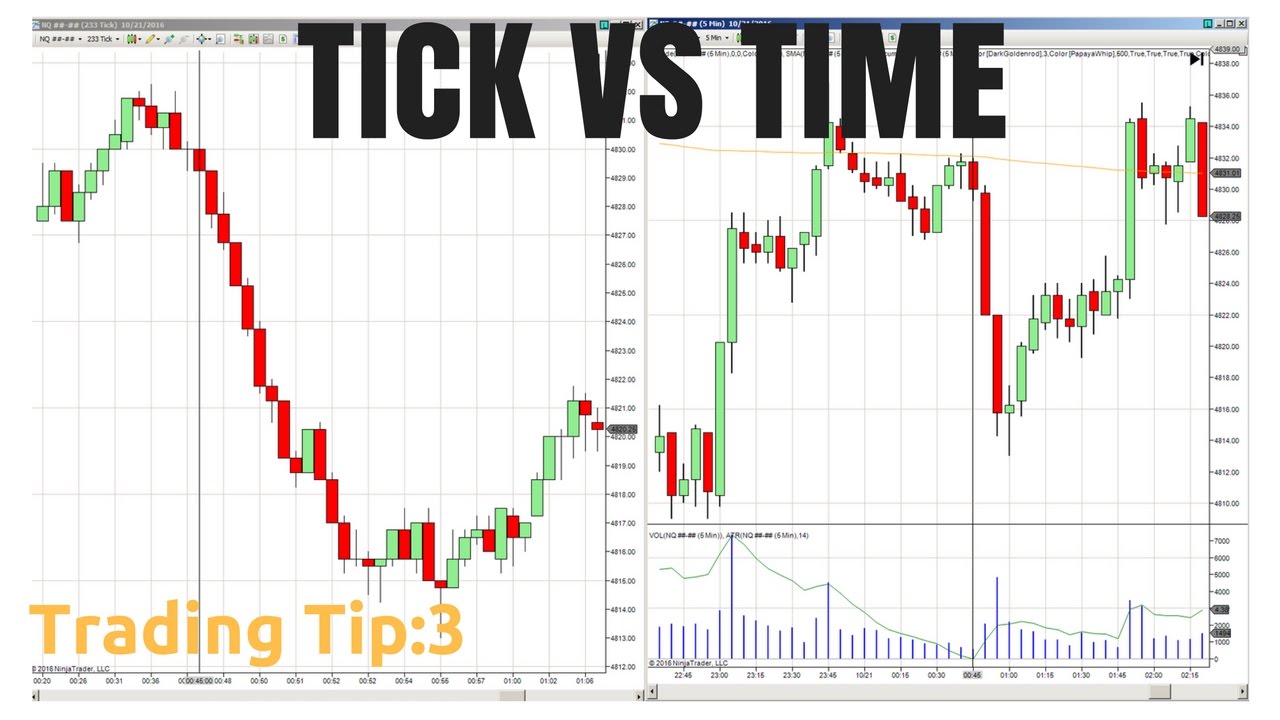

31/05/ · Choose Volatility 10 or 25 index RISE/FALL trading Duration 1 Ticks How to Analyze The analysis starts from seconds and seconds. It is recommended to only make a purchase 1 time in one minute with a note that a moment occurs. OP LOWER If from Ticks there is a downward price correction, make a purchase (LOWER).Author: Sportmania 07/02/ · Tick charts help traders track down events at a point in time. Tick scalping can be executed on both short and long sides and scalpers should consider balancing long and short trades to get the best results. Spotting the trend and momentum helps a trader make better profits by entering and exiting briefly in a repeated pattern 15/05/ · Tick trading strategies can be super simple. The main criterion is that it gives you good odds at winning. As a rule of thumb, if it gets you 2 wins out of 3 on average. It’s a good trading strategy. Step 2: Document your trading strategy The next step is to describe and document your tick trading strategy so you have something to work blogger.comted Reading Time: 5 mins

10 Ridiculously Powerful Trading Strategies For Beginners | IFMC Institute

A winning strategy is the most important part of a trading plan. If you want to win consistently, you must have a good trading plan. So how do you come up with a winning tick trading strategy?

And how do you know that it is any good? Here are 7 essential steps that will take you from devising your strategies to tick trading strategies your plan, tick trading strategies. If you are new to tick trading, you would just launch the app and trade away.

You follow the ticks, you look at the graph, tick trading strategies, you play around with the interface — there are over 20 tick trading strategies to pick from and 4 technical indicators to play with. You might already have picked your preferred assets and are using some of the technical indicators.

Chances are, you are trading a few of these patterns, not just one. You may be trading intuitively like this with technical indicators on your charts. If you have been spotting patterns and trading them, you have actually devised some simple mental trading strategies. This is a good starting point. Tick trading strategies can be super simple. The main criterion is that it gives you good odds at winning. As a rule of thumb, if it gets you 2 wins out of 3 on average.

The next tick trading strategies is to describe and document your tick trading strategy so you have something to work with. Just keep it really simple, describe your strategy as if you are sharing a useful trick with a friend.

Just write it out in note form. And give it a name. Strategy: 3-tick trend Spot good trend pattern tick trading strategies looking at graph. Look for clear trend, not too many zigzags. Set tick duration to 5. Look for 3 consecutive ticks in same direction. Either Up Up Up or Down Down Down. Then enter trade in same direction immediately after 3 rd tick. Do the same for your top mental strategies. Try something different this time, expand your comfort zone.

Put them on your chart one at a time. See if you can find some good trading patterns with that indicator. To up your game, try having 2 indicators on your chart at the same time. I find 2 to be the best, tick trading strategies. I tend to tick trading strategies Bollinger Band with one of the MA moving average indicators. Combining any 2 of the moving average indicators also works well.

Once you have found the right strategy and trading the right asset tick trading strategies the right time. The crux is identifying the right asset and sometimes the right time of day when your strategy works the best.

Go ahead and test your strategies, one at a time. It is crucial that when you are testing your strategy, you only trade that strategy pattern and nothing else, or your results would be tainted.

Then document your test results on a spreadsheet. Note down the asset, the time of the session. The exact indicators use and the strategy use. And the trading outcome. Get a win rate tally. The more data points you have for your strategy, the better. As you test your tick trading strategies, you will find that sometimes you lose. And there is often a good reason for it, tick trading strategies. Not just to prove a viable win rate but for you to improve your strategy.

So you have tested and proven that a given strategy works. Optimizing the strategy means finding the best conditions where the strategy yields the best results. This could be only trading certain assets, or avoiding certain times such as news announcement, market opening or closing. You might also want to be specific about the underlying bigger patterns, whether to only trade with those bigger patterns or to abstain.

I talked about Plan your trades and trade your plan in the last post. This is a must if you want to win consistently and always come out on top. Having a winning strategy or two is a must for your trading plan and ultimately, key to your trading success.

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

RISE/FALL 1 Tick Accurate Trading Strategy -- Binary,com -- Strategy Profit

, time: 11:03Trading strategy for tick trading – How to devise and test - BonusTrade App

07/02/ · Tick charts help traders track down events at a point in time. Tick scalping can be executed on both short and long sides and scalpers should consider balancing long and short trades to get the best results. Spotting the trend and momentum helps a trader make better profits by entering and exiting briefly in a repeated pattern 14/02/ · 10 Powerful Stock Trading Strategies # 1 Uni-directional Trade Strategies – Best day trading course # 2 Growth Investing # 3 Income Investing # 4 Short Selling # 5 Value Investing # 6 Momentum Investing # 7 Quality Investing # 8 Trend Following # 9 Gap Strategy # 10 Flag Pattern How to build an effective stock trading strategy? 1 15/05/ · Tick trading strategies can be super simple. The main criterion is that it gives you good odds at winning. As a rule of thumb, if it gets you 2 wins out of 3 on average. It’s a good trading strategy. Step 2: Document your trading strategy The next step is to describe and document your tick trading strategy so you have something to work blogger.comted Reading Time: 5 mins

No comments:

Post a Comment