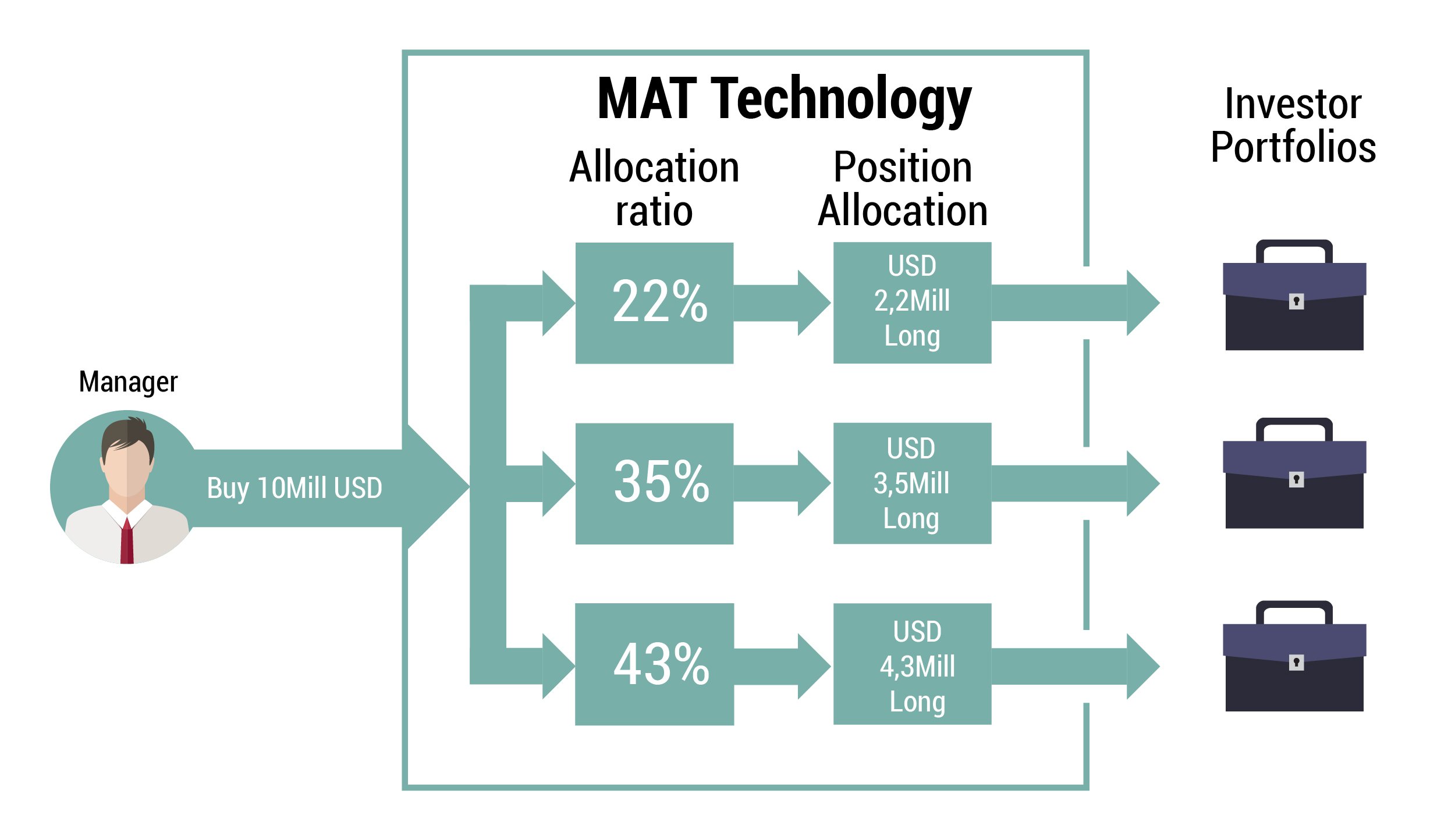

The PAMM or Percentage Allocation Management Module is a trading platform that simultaneously administrates an unlimited quantity of managed accounts. At the same time, traders create trading positions, PAMM copy trades, and distribute the sizes of trades according to an allocation percentage to the investor’s account What is a PAMM account? The PAMM account features a management module that distributes the sizes of trades according to an allocation percentage. This solution is offered by many forex brokers for investors and fund managers. With a PAMM account, an investor can also allocate a percentage of his account to one or more managers · PAMM Account in Forex is a trading platform that allows for the management of an unlimited number of accounts managed concurrently. Simultaneously, traders build trading positions, PAMM copies deals, and distributes trade sizes based on an investor’s allocation percentage. Investing clientele may be many yet rely on a single trader

Guide To Forex PAMM Accounts - Main Pros & Cons Of Using PAMM

Forex trading is a risky business that requires a trader to have the necessary skills and experience to tackle the markets in a consistently profitable manner, what is pamm account in forex. As far as the overall profitability of Forex traders is concerned, only a small percentage of traders can enjoy profitable results, which not only requires talent but also requires a trader to have perseverance and high levels of discipline to be on top of what the market throws at them.

Most investors usually lack the qualities needed to become a successful Forex trader. Therefore, a significant number of investors look for hiring the services of established traders that provide managed account services in return for a fixed performance fee. Forex managed account is a concept that revolves around the traditional hedge fund platform, but something that is more suited to the Forex trading environment.

Most new Forex brokers now provide the option of a managed account, which provides an opportunity for fund managers to meet investors from any part of the world and offer their trading services by managing accounts and portfolios on behalf of the investor.

Managed accounts have a significant amount of popularity in the retail trading market, especially among institutional investors who are looking for talented Forex traders to manage large capital through several investment funds that promise high yield at low risk. Brokers offer various types of managed accounts, and it is easy to find brokers with MAM, PAMM, LAMM account offerings that are aimed to create different types of managed accounts according to trader and investor preferences.

Here is a breakdown of the most popular managed account platforms currently available in the Forex trading industry: Multi-Account Manager MAM Accounts MAM Accounts help the trader to manage multiple trading accounts using a single terminal. MAM accounts make use of combining individual trader accounts into a large pool of managed fund that comprises of individual trader accounts as well as investor accounts.

All orders executed on the master trading account are reflected on every associated MAM account according to the parameters set by the investor. Investors also have the option of entering orders through their individual trading accounts and are free to modify MAM trades according to their preferences.

The performance fee is paid to the master trader according to his performance and as a percentage of the returns. MAM account is an advanced type of managed account that offers excellent control for an investor and has several features enjoyed by both PAMM as well as LAMM accounts. PAMM accounts allow investors to allocate a percentage of their trading capital to copy trades from a master account.

PAMM is different from other types of managed accounts, as PAMM investors can follow different trader accounts and diversify their trading capital by allocating different percentages to different trading what is pamm account in forex. PAMM accounts offer more flexibility for the investor to choose multiple trading systems and hedge against any performance issues that may arise out of losses from specific master trading accounts.

Lot Allocation Management Module LAMM Accounts In LAMM accounts, the what is pamm account in forex chooses the amount of lots that can be traded in the market, what is pamm account in forex, and the profits or losses are determined according to the multiples of lots invested in the market. LAMM is a more basic iteration of the PAMM account that aims to lower the risk of trading and is usually suited for larger accounts that have a higher trading capital.

LAMM accounts are typically used when percentage allocation loses significance due to the higher trading capital, as a higher trading capital will have significant issues while filling orders at the interbank exchanges. Managed accounts serve as a highly transparent what is pamm account in forex safe form of investment, what is pamm account in forex, which provides multiple levels of control for both the trader as well as the investor. Professional traders with varying degrees of expertise can offer different types of account options to investors according to the magnitude of the investment and the risk appetite.

Traders are free to charge their performance fee according to their preferences, and investors have the ability to verify the performance of traders before investing in a managed fund. Investors usually have the option of investing their money in a managed fund or open separate trading accounts which can then be linked to a managed account through the broker platform.

Managed account investors can view a broad range of performance indicators such as trading history, profit potential, and risk factor before choosing to invest in a managed fund. One of the most important aspects of managed accounts is the safety of funds in a managed account. Managed accounts only serve as a pool of investments that follow the trading pattern according to a set of terms and conditions.

An investor can choose the trading conditions and minimize or maximize risk according to their risk appetite and trading preferences. Managed accounts are entirely safe from any form of trader or broker manipulation; however, the risk factor of managed accounts always depends on the profitability of a trader.

Managed accounts should not be considered as a safe and profitable alternative to Forex trading, as every investment has the risk of loss and is not free from market volatility. Human psychology also plays a significant role in determining the safety of funds in a managed account, as an investor can lose a majority of his capital if the trader succumbs to his emotions. Some trading strategies are also known to resemble a gambling attitude, which can enjoy long-term winning streaks, but losses can exceed the initial trading capital, which can spell disaster for an investor if he is not careful against such trading tendencies.

Some managed accounts offer immense amounts of flexibility and freedom for controlling their investments, but it can also act against an investor if he is not careful about managing his open positions. Some long-term traders are confident of holding on to losing trades as they expect them to return to profits in the long run, but short-term traders with a higher leverage may find such strategies to be in contradiction with their primary account size.

Long-term strategies may not be what is pamm account in forex for small account holders, which can potentially blow an account if the investor is not careful while choosing their account manager. Nevertheless, managed accounts do offer the option of investing in the markets without worrying about the lack of knowledge or the expertise required to trade in consistent profits, what is pamm account in forex. Traders should always perform their homework before investing in managed accounts, as managed accounts are not guaranteed to return positive results every time.

What Are The Different Managed Account Platforms? Sign Up Review.

Forex Millionaire Shares How Forex PAMM Accounts Work

, time: 1:43What is a PAMM Account in Forex?

· The acronym ‘PAMM’ stands for ‘percentage allocation management module’, while this type of account may also be referred to as ‘percentage allocation money management’. This represents a form of pooled money for forex trading, which enables an investor to allocate their money in a predetermined proportion to a qualified trader or money The PAMM or Percentage Allocation Management Module is a trading platform that simultaneously administrates an unlimited quantity of managed accounts. At the same time, traders create trading positions, PAMM copy trades, and distribute the sizes of trades according to an allocation percentage to the investor’s account What is a PAMM account? The PAMM account features a management module that distributes the sizes of trades according to an allocation percentage. This solution is offered by many forex brokers for investors and fund managers. With a PAMM account, an investor can also allocate a percentage of his account to one or more managers

No comments:

Post a Comment