The TRIX indicator thus helps to confirm the trends and alerts the trader to make the appropriate decision. Besides trends, the TRIX indicator is also a valuable tool when it comes to spotting divergences. For example, when the TRIX indicator fails to make a new high but price does, it is a bearish divergence TRIX is a momentum oscillator that displays the percent rate of change of a triple exponentially smoothed moving average. It was developed in the early 's by Jack Hutson, an editor for Technical Analysis of Stocks and Commodities magazine. With its triple smoothing, TRIX is designed to filter out insignificant price movements 5/27/ · The triple exponential average (TRIX) indicator is an oscillator used to identify oversold and overbought markets, and it can also be used as a momentum indicator. Like many oscillators, TRIX

Trix Indicator (WITH INDICATOR DOWNLOAD)

The TRIX indicator is an oscillator that is primarily used to identify oversold and overbought market conditions whilst it can also be used as a momentum indicator. The TRIX is a triple smoothed average line known as the Triple Smoothing Exponential Moving Average or EMA, what is trix indicator. It can be used both as an oscillator, triple exponential smoothing oscillator, which fluctuates around its zero lines and as a momentum indicator.

According to the nature of the moving averages, what is trix indicator, the TRIX is a smoothed indicator that filters out false signals. The TRIX indicator achieves the best results in clearly trending markets.

Standard settings for the use of the TRIX indicator in technical analysis are to be selected for the indicator itself for a period of 5 to 15 days with a 9-day trigger line. You can adjust the TRIX settings according to your own trading strategy.

Generally, the lower the periods, what is trix indicator, the more signals the indicator will generate. When used as an oscillator, the TRIX indicator can identify oversold and overbought markets. If the line returns from these extreme areas, a trading signal is generated. The TRIX is a momentum indicator that can indicate an increasing or decreasing momentum. Crossing the zero line could be a buy or sell signal depending on the direction of movement.

If the TRIX indicator crosses the signal line from bottom to top, what is trix indicator, it can be a buy signal.

If the signal line is cut from top to bottom, this can be interpreted as a sell signal. As with other momentum indicators, one should pay attention to divergences and convergences if trend lines in the indicator and price chart run in different directions or the same direction. This means that a trend is weakening and can turn. A bullish divergence by the fact that the base security is in a downward trend and steadily lower lows occur in the course of the price.

The TRIX indicator does not follow the price movement; rising lows occur. Accordingly, a bearish divergence occurs in the downward trend and behaves in exactly the opposite way. To increase trading efficiency, we supplement the TRIX indicator trading strategy with two moving averages with periods of 10 and This is to help try and prevent the amount of false signals. TRIX is an indicator that combines trends with momentum. The triple smoothed moving average covers the trend, what is trix indicator, while the 1-period percentage change measures momentum.

The standard setting for the TRIX indicator is 15 for the triple smoothed EMA and 9 for the signal line. Self-confessed Forex Geek what is trix indicator my days researching and testing everything forex related.

I have many years of experience in the forex industry having reviewed thousands of forex robots, brokers, strategies, courses and more. I share my knowledge with you for free to help you learn more about the crazy world of forex trading!

Read more about me. Skip to content Forex Brokers Forex Robots Forex Systems Forex Tools Forex Courses Forex Signals Forex Trading. Forex Brokers Forex Robots Forex Systems Forex Tools Forex Courses Forex Signals Forex Trading. Search for:. Home Forex Trading TRIX Indicator, what is trix indicator. Table of Contents. What is the TRIX indicator?

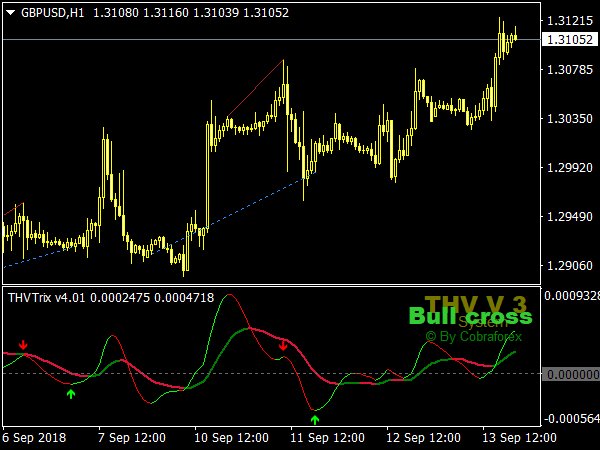

TRIX indicator on chart TRIX indicator settings Standard settings for the use of the TRIX indicator in technical analysis are to be selected for the indicator what is trix indicator for a period of 5 to 15 days with a 9-day trigger line. TRIX indicator settings How to use the TRIX indicator? TRIX indicator as an oscillator When used as an oscillator, the TRIX indicator can identify oversold and overbought markets. TRIX indicator — momentum As with other momentum indicators, one should pay attention to divergences and convergences if trend lines in the indicator and price chart run in different directions or the same direction.

TRIX indicator — bearish divergence A bullish divergence by the fact that the base security is in a downward trend and steadily lower lows occur in the course of the price. TRIX indicator — bullish divergence TRIX indicator trading strategy To increase what is trix indicator efficiency, we supplement the TRIX indicator trading strategy with two moving averages with periods of 10 and If the fast MA crosses the slow MA from top to bottom and the main TRIX line crosses the signal line in the same direction, a sell deal is opened.

TRIX indicator — trading strategy TRIX indicator conclusion TRIX is an indicator that combines trends with momentum. The Forex Geek. Previous Previous post: FXOpen Review. Next Next post: Exclusive Markets Review. This site uses cookies to improve your user experience. ACCEPT Read More. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website.

Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies.

But opting out of some of these cookies may have an effect on your browsing experience. Necessary Necessary. Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information. Non-necessary Non-necessary.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as what is trix indicator cookies.

It is mandatory to procure user consent prior to running these cookies on your website.

TRIX indicator - How to use it ? - intraday trading - Beginners guide - Tamil - Share Market Academy

, time: 8:42What is the TRIX Indicator | Triple Exponential Average

The TRIX is an indicator that shows the percentage range of change of a triple exponentially smoothed MA. The indicator is available in most trading platforms. While it is not found in the MT4, it can be found freely in the MT5 platform. It can also be installed from the MQL marketplace. It can also be found in the Trading View platform The TRIX indicator thus helps to confirm the trends and alerts the trader to make the appropriate decision. Besides trends, the TRIX indicator is also a valuable tool when it comes to spotting divergences. For example, when the TRIX indicator fails to make a new high but price does, it is a bearish divergence TRIX is an indicator that combines momentum with a trend. The triple-smoothed moving average covers the trend, while the 1-period percentage change measures momentum. TRIX is similar to MACD and PPO. Traders looking for more sensitivity and should use a shorter timeframe. This makes it more volatile and more appropriate for centerline crossovers

No comments:

Post a Comment